How to request Federal Direct Student Loans

- You must be enrolled in at least 6 financial aid-eligible credits to receive Direct Student Loans. Log in to e-services using your StarID and password. Then click on “Financial Aid” and then “Loans”.

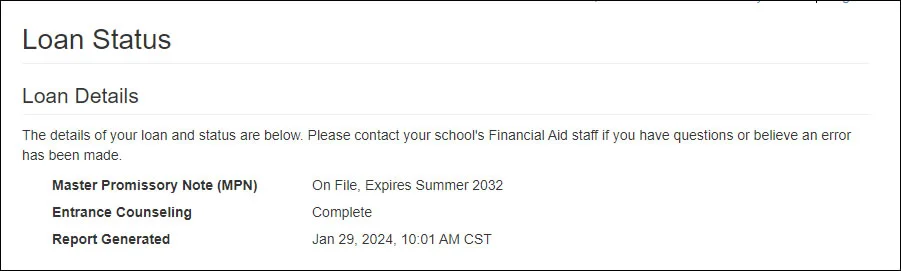

- Complete Direct Student Loan pre-requirements, listed and linked below.

You may have already completed these steps in the past. If you have already done so, your Master Promissory Note will be listed as “On File” with an expiry term in the future and your Entrance Counseling will be listed as “Complete”.

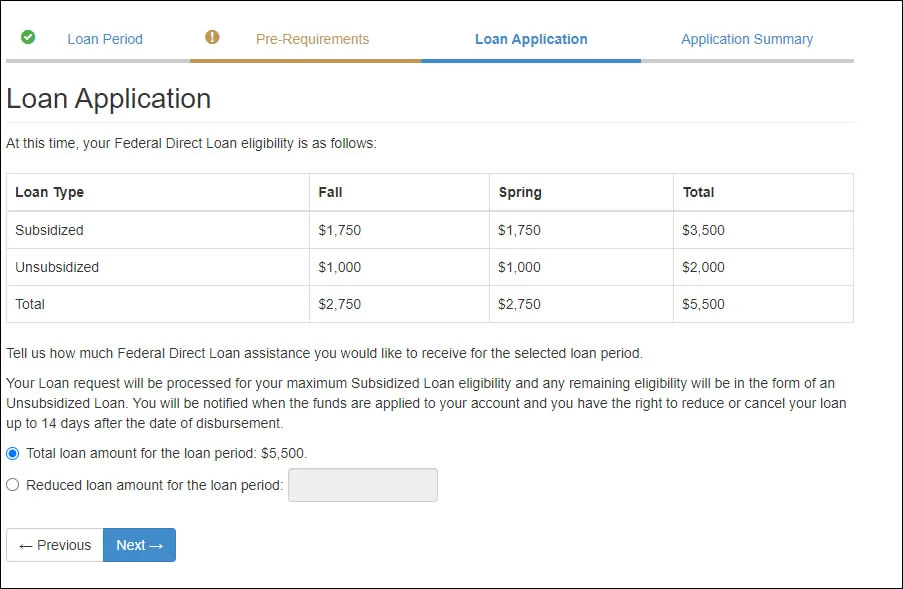

- Complete the loan request. You can accept the full amount or a reduced amount. Please take note of the following:

- The US Department of Education currently charges an origination fee on all Federal Direct Student loans of 1.057% of the principal amount. This fee will be deducted directly from your loan and will reduce the amount of your loan disbursement by the amount of the origination fee. If you are requesting a specific loan amount to cover just the balance you owe on your student account, you must increase your loan request slightly to account for this fee. To do so, round the amount you want your loan to pay up to the nearest whole dollar. Then multiply that amount by 1.0107 and once again round up to the nearest whole dollar to find the amount you should request.

- The amount that you request will be split between fall and spring unless the financial aid office is aware that you will not be attending one of the semesters. During the fall semester, you can only request loans for the full year. One-half of the amount you request will be requested for disbursement in the fall semester and the second half for the spring semester.

- Check your Lake Superior College email daily. If any steps are incomplete or if we need additional information to process the loan, we will contact you via your LSC email.

- Check your Financial Aid Status in e-Services weekly. Once the loan has been processed, the loan status will update from “processing” to “certified”. Completed loan requests take about 1 to 3 business days to process once we have begun processing loans for the academic year of your loan(s).

Parent PLUS Loans: Parents of dependent students can request PLUS loans. Find out if you qualify and apply for a PLUS loan (loans to parents).

Direct Student Loan Disbursement

New Loan Borrowers: There is a 30 day delay for new loan borrowers. The first disbursement for a new loan borrower will occur no earlier than 30 days into the semester as long as the loan has been processed and the student is enrolled in at least 6 financial aid-eligible credits. If the new loan borrower applies for a loan after the 30 day delay, the loan will disburse onto their account within a week of the loan being processed.

Non-new Loan Borrowers: A loan that is processed at least a week prior to the end of the add/drop period will apply to the student’s account as long as they are in at least 6 financial aid eligible credits. After the second week of classes, the loan disbursements will occur within a week after the loan has been processed.

Direct Loan disbursements are applied to the students outstanding tuition and fees. If there is a refund, this will be sent to BankMobile Disbursements, a technology solution, powered by BMTX, Inc. to be disbursed to students according to their selected refund preference with BankMobile Disbursements.

Fall-Spring Loan Requests: If a loan request is for Fall-Spring, the loan will have two disbursements during the loan period. The first disbursement will be in the Fall semester and the second disbursement will be in Spring semester.

One-term Loan Requests: If a loan is processed for one semester only, the loan will have two disbursements within the semester the loan was processed for. The second disbursement will be no earlier than the midpoint of the semester.

Parent PLUS Loan: Learn more about PLUS loan disbursements.

Direct Loan Repayment

For subsidized and unsubsidized loans, students will need to start making payments 6 months after the student is no longer enrolled half-time, withdrawn, or has graduated. The student will need to complete exit counseling when this happens. There are several repayment plans that a student can choose from. Please contact the student loan servicer for more information or visit studentloans.gov.

Parent PLUS Loan: Learn more about PLUS loan repayment.